RP’s Legal Win: What the 2023 Ruling Means for Ripple and the Future of Cross-Border Payments

Introduction

So XRP is a cryptocurrency that was developed by Ripple Labs, which has been at the center of significant legal and market developments over the past few years. XRP has established a niche in the blockchain ecosystem with its use case in cross-border payments and partnerships with financial institutions. But its future has been complicated by a long-running legal battle with the U.S. Securities and Exchange Commission (SEC). Here’s a rundown of the important developments and what they mean for the future of XRP.

The SEC Lawsuit: A Bitter Case That Is Not Closing

In 2020, the SEC sued Ripple Labs, claiming the company’s sale of XRP was an unregistered securities offering. The lawsuit sent shockwaves throughout the cryptocurrency community as it left thousands of crypto enthusiasts questioning the regulatory status of numerous digital assets. the SEC contended that Ripple’s sale of XRP was needed to be registered as a security while Ripple argued that XRP was a digital currency, and as such, not a security under U.S. law.

The lawsuit has been prolonged, with Ripple and the SEC filing motions, evidence, and legal interpretation fights. Its ruling was widely expected to have implications that extended well beyond Ripple, the entire cryptocurrency market having spent years awaiting clearer regulatory direction on digital assets. Coindesk

Ripple’s July 2023 Partial Victory

Ripple Labs won a partial victory in its legal tussle with the SEC in July 2023. A judge ruled that XRP is not a securities when sold on public exchanges to retail investors. This was a huge win for Ripple as it essentially removed the giant cloud of uncertainty hanging over this digital asset in the general market.

But the decision wasn’t a clean victory for Ripple. It also ruled that the sale of XRP to institutional investors in private sales counts as a securities transaction. It’s a nuanced distinction, but it also means some aspects of the case are still standing, and Ripple plans to appeal the remaining elements in which XRP is ruled a security in private transactions.

This partial judgment did send XRP’s price surge, as the cryptocurrency saw a major increment in value on the back of the announcement. It also rekindled investor interest in Ripple’s potential — and the greater promise of XRP as a mainstream digital asset.

The Role of XRP in Cross-Border Payments

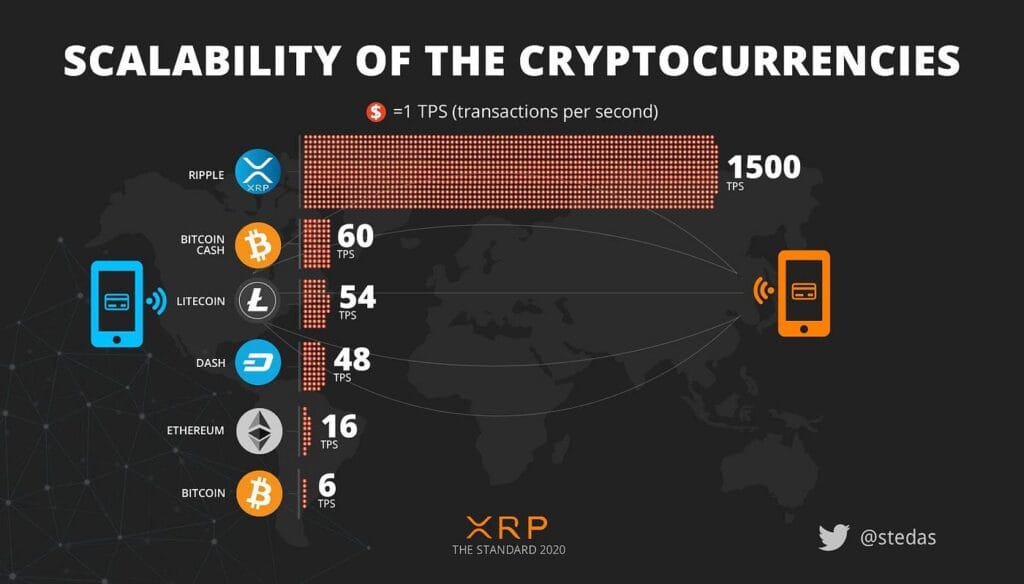

Ripple, which is the technology underlying XRP, has been involved in bank partnerships to facilitate cross-border transactions, and that wherever XRP is used, it would be in high demand from banks to enable currency conversion on their side. Ripple has long been positioning XRP as a cheaper and faster option to international money transfers via traditional financial systems. Unlike traditional banking methods where transactions can take hours or even days, XRP can be transferred within a few seconds.

Ripple’s tech has been successfully used for cross-border transactions with partnerships with many global enterprises. This is appreciated against the backdrop of the growing trend of migration and globalization, which has positioned XRP as an up-and-coming remittance bridge to address the gap of real time payments between countries with different currencies.

Regardless, Ripple has maintained its efforts toward utilizing XRP as a global bridge currency, in the face of legal pushback from the SEC. Ripple also stands to benefit from some regulatory clarity in the U.S. and further afield, following the partial legal victory in 2023, which could help accelerate adoption.

COURSE 12: The Global Regulatory Landscape

XRP’s fight with the SEC is just one chapter in a larger story about crypto regulation. Around the world, governments and regulators are wrestling with how to categorize and regulate digital assets. Some countries such as El Salvador have adopted cryptocurrencies as legal tender, while others have been more cautious, enacting strict regulations or outright bans.

Ripple has consistently pursued the enhancement of its global presence, particularly during times of regulatory clarity in different geographical landscapes. The company has partnered with more financial institutions outside the U.S. than it has domestically, revealing XRP’s potential in global markets even amid legal challenges domestically.

What’s Next for XRP?

That being said, the future and legal landscape for XRP is still being worked out, litigation and appeals processes are never quick affairs. There are yet a few decisive factors that will figure out the continuation of XRP here:

Appeals and Final Ruling: Ripple will likely appeal the portions of the judgment that find XRP to be a security in private sales. The decision of this appeal will be decisive to establish the long-term regulatory approach toward XRP and impact its price and adoption.

Market SentimentDespite facing legal challenges, XRP has showed great resilience in the market. The cryptocurrency market is known for its volatility, but Ripple’s partnerships, technological advances, and legal developments have helped keep XRP relevant.

Regulatory Certainty in the U.S.: With regulators globally still drafting policies for digital assets, U.S. regulators will play a pivotal role in creating the framework for XRP. If the SEC’s attitude on XRP is definitively made clear or reformed, this may open the way for more widespread use of the token.

Global Adoption Ripple continues its push for XRP to be used in cross-border payments, and XRP’s utility will be a major factor for its long-term viability. As Ripple gets traction in new markets and continues to build its technology, XRP could become a go-to for cross-border payments — and it won’t matter so much what happens in the U.S.

Conclusion

XRP underwent a tumultuous journey, including legal battles, market fluctuations, and a fight for regulatory clarity. The partial victory in the SEC case has provided Ripple and XRP supporters with some hope, the path forward for the asset remains a mystery. Nonetheless, due to its usefulness in global payments and increasing international partnerships, XRP is still a crypto to monitor. While the legal landscape remains extremely fluid, and Ripple moves forward with its plans, XRP’s position in the crypto landscape could become a key one in the coming years.

Only time will tell if XRP will become a standard for global payments or continue to hit roadblocks on its path to mainstream adoption.

Do follow for more news: DailyForesight