American Electric Power (AEP) Unveils $54 Billion Investment Plan Amid Strong Earnings Growth

Introduction

In a rapidly evolving energy landscape, American Electric Power (AEP) continues to assert its position as a leading utility provider in the United States. The company’s recent third-quarter 2024 earnings report and announcement of a $54 billion investment plan signal a robust future for AEP, with ambitious projects aimed at modernizing the grid, expanding renewable energy resources, and positioning the company for long-term growth. As one of the largest electric utilities in the country, AEP’s latest developments are closely watched by investors, customers, and industry experts alike.

In this article, we’ll dive deep into American Electric Power financial performance, strategic initiatives, and the challenges it faces as it navigates an ever-changing energy market. We’ll explore the company’s ambitious capital investment plan, its growth projections for the next few years, and how its commitment to sustainability and infrastructure modernization plays a pivotal role in shaping its future.

American Electric Power’s Q3 2024 Earnings: A Mixed Performance with Strong Operational Growth

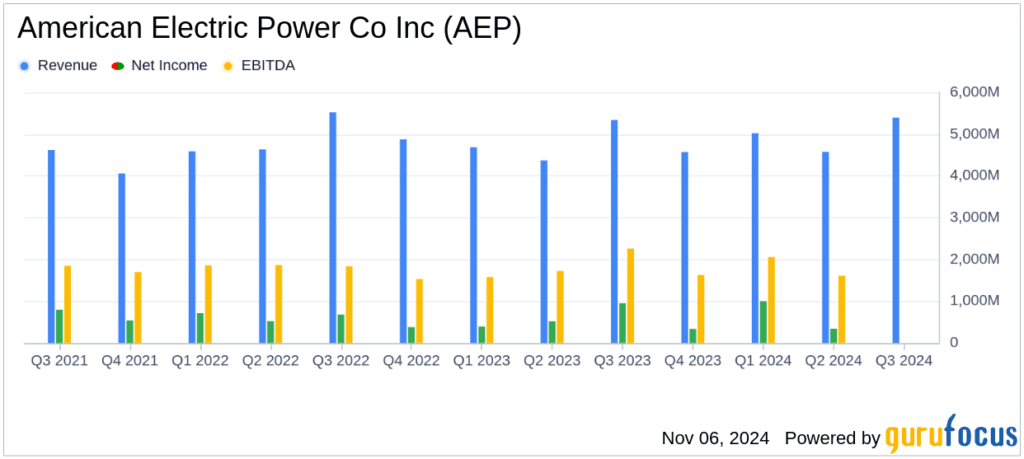

American Electric Power’s earnings report for Q3 2024 showed solid performance, despite some challenges in its Generation & Marketing segment. The company reported GAAP earnings of $960 million or $1.80 per share, which was slightly lower than Q3 2023, when American Electric Power posted $954 million or $1.83 per share. However, the operating earnings (a non-GAAP measure) for Q3 2024 were $985 million, or $1.85 per share, up from $924 million or $1.77 per share in the same quarter last year【19†source】.

This increase in operating earnings reflects AEP’s ongoing commitment to improving service quality and enhancing its energy infrastructure. The company attributes the growth in operating earnings to investments in grid modernization, expansion of renewable energy sources, and addressing the increasing demand for electricity, particularly from industrial customers.

Despite a small dip in GAAP earnings, American Electric Power’s operating earnings growth is a testament to the strength of its core operations, which continue to benefit from increased commercial load and investments in infrastructure upgrades. With commercial load growth reaching 10% year-over-year, AEP is well-positioned to take advantage of the growing demand for energy, particularly in key markets like Ohio, Texas, and Indiana【19†source】【17†source】.

$54 Billion Capital Investment Plan: A Strategic Investment for the Future

The most significant news from American Electric Power’s recent earnings announcement is the $54 billion capital investment plan set to unfold over the next five years. This investment is aimed at modernizing AEP’s energy infrastructure, improving grid reliability, and expanding capacity to meet future energy demands. The capital expenditure will be spread across grid modernization, renewable energy projects, advanced metering technologies, and the expansion of transmission networks.

The investment plan reflects AEP’s forward-thinking approach to addressing the growing needs of its customers, particularly in industrial and data-driven sectors. American Electric Power has already secured agreements for 20 gigawatts of load additions through 2030, which will be instrumental in driving long-term revenue growth. These new contracts primarily target data centers, industrial customers, and other large-scale energy consumers across AEP’s service territories【19†source】.

This substantial capital plan comes at a time when the energy sector is undergoing a profound transformation. With increasing demand for clean and reliable energy, AEP is positioning itself as a leader in the shift toward renewable energy while simultaneously modernizing its aging infrastructure. The company’s ambitious plans are designed not only to increase its capacity to meet demand but also to improve the overall resilience of the energy grid.

Growth Projections: AEP’s Long-Term Strategy

Looking ahead, American Electric Power’s financial guidance for 2025 and beyond indicates strong growth prospects. The company has updated its long-term growth rate to 6%-8%, which is based on projections of operating earnings in the range of $5.75 to $5.95 per share for 2025【19†source】. This represents a healthy outlook for the utility, fueled by continued investments in infrastructure and renewable energy.

The company’s focus on grid modernization and expansion of renewable energy projects will likely play a significant role in achieving this growth. AEP’s ongoing efforts to integrate wind and solar energy into its generation mix align with broader industry trends toward decarbonization and environmental responsibility. As AEP invests in clean energy solutions, it also ensures compliance with increasingly stringent regulatory requirements and anticipates future shifts in energy consumption patterns.

AEP’s long-term growth strategy is backed by its ability to adapt to market conditions and navigate the regulatory landscape effectively. The company’s focus on data-driven energy demands and the need for energy efficiency in industrial and commercial sectors will ensure that AEP continues to provide reliable, affordable, and sustainable energy. PR Newswire, Yahoo! Finance

Sustainability and Renewable Energy: AEP’s Commitment to Clean Energy

American Electric Power has made significant strides in expanding its renewable energy portfolio. The utility’s clean energy initiatives are an essential part of its $54 billion capital investment plan, which includes a strong focus on wind, solar, and battery storage technologies. AEP aims to reduce its carbon footprint and increase its reliance on clean, renewable sources of energy.

The company is actively investing in large-scale solar farms and wind power projects, which are critical to meeting its sustainability goals. These renewable energy projects not only help reduce the environmental impact of AEP’s operations but also contribute to job creation and economic development in local communities.

AEP is also increasing its efforts to deploy energy storage systems that will allow it to better manage supply and demand fluctuations. These systems will play a vital role in stabilizing the grid, especially as more intermittent renewable energy sources like wind and solar are integrated into the grid. By expanding its renewable energy capacity and focusing on smart grid technologies, AEP is positioning itself as a forward-thinking utility provider ready to meet the energy challenges of the future. PR Newswire, Yahoo! Finance

Challenges: Decline in Generation & Marketing Segment

Despite the positive growth in most areas, American Electric Power did face some setbacks in its Generation & Marketing segment. This division saw a decline in earnings by $37.4 million year-over-year, largely due to a reduction in activities within the segment. The company has made strategic decisions to scale back some of its operations in this area, focusing instead on higher-priority investments in grid and renewable energy infrastructure【19†source】.

This slowdown in the Generation & Marketing segment is a reminder that the utility sector is not without its challenges. Regulatory changes, fluctuating fuel prices, and evolving customer preferences can impact the profitability of certain divisions. However, AEP’s proactive approach to restructuring and focusing on its core growth areas ensures that the company remains on track for long-term success.

Investor Sentiment: Optimism Amid Market Volatility

American Electric Power’s financial results have generated mixed reactions from analysts and investors. While some have raised concerns about the dip in earnings in the Generation & Marketing division, the overall outlook for AEP remains positive. The company’s $54 billion capital plan, long-term growth targets, and focus on renewable energy and grid modernization have led many to view American Electric Power as a solid investment in the evolving energy sector.

AEP’s stock performance has experienced some fluctuations, especially with recent downward revisions in price targets by certain analysts. However, the company’s strategic investments and strong earnings growth suggest that it is well-positioned to weather market volatility and continue to deliver long-term value to its stakeholders【17†source】.

The Road Ahead: Key Takeaways for AEP’s Future

American Electric Power’s recent announcements signal an exciting future for the company. With a $54 billion investment plan, a solid growth trajectory, and a commitment to renewable energy, American Electric Power is poised to lead the way in the transformation of the U.S. energy sector.

As the company continues to modernize its infrastructure, expand its renewable energy capacity, and navigate regulatory changes, it will remain a key player in the energy industry. AEP’s focus on sustainability, operational efficiency, and technological innovation ensures that it will be well-prepared to meet future challenges and capitalize on new growth opportunities.

Frequently Asked Questions (FAQs)

What are AEP’s earnings for Q3 2024?

American Electric Power reported GAAP earnings of $960 million or $1.80 per share for Q3 2024, with operating earnings of $985 million or $1.85 per share【19†source】.

What is the $54 billion investment plan announced by AEP?

The $54 billion investment plan focuses on grid modernization, renewable energy expansion, and infrastructure upgrades to meet growing energy demand【19†source】.

What is AEP’s long-term growth forecast?

AEP has projected a 6%-8% growth rate over the long term, with earnings guidance of $5.75 to $5.95 per share for 2025【19†source】.

What renewable energy projects is AEP investing in?

AEP is expanding its solar and wind energy projects, along with battery storage systems, to increase its reliance on clean energy sources【18†source】.

What challenges is AEP facing in its Generation & Marketing segment?

AEP saw a decline in earnings in its Generation & Marketing segment, largely due to scaled-back activities and restructuring efforts【19†source】.

How does AEP’s investment in sustainability benefit the company?

AEP’s investment in renewable energy helps reduce its carbon footprint, meet sustainability goals, and contribute to grid reliability【18†source】.

Conclusion

American Electric Power (AEP) is undergoing significant transformation with its strategic investments in infrastructure, renewable energy, and grid modernization. While facing challenges in its Generation & Marketing division, the company’s $54 billion investment plan, long-term growth projections, and commitment to clean energy position it well for future success. AEP’s focus on sustainability, technological innovation, and renewable energy will be crucial as the energy sector evolves.

Investors and stakeholders should continue to monitor AEP’s progress as it navigates the complexities of the energy market and capitalizes on new growth opportunities.

Do follow for more news: DailyForesight