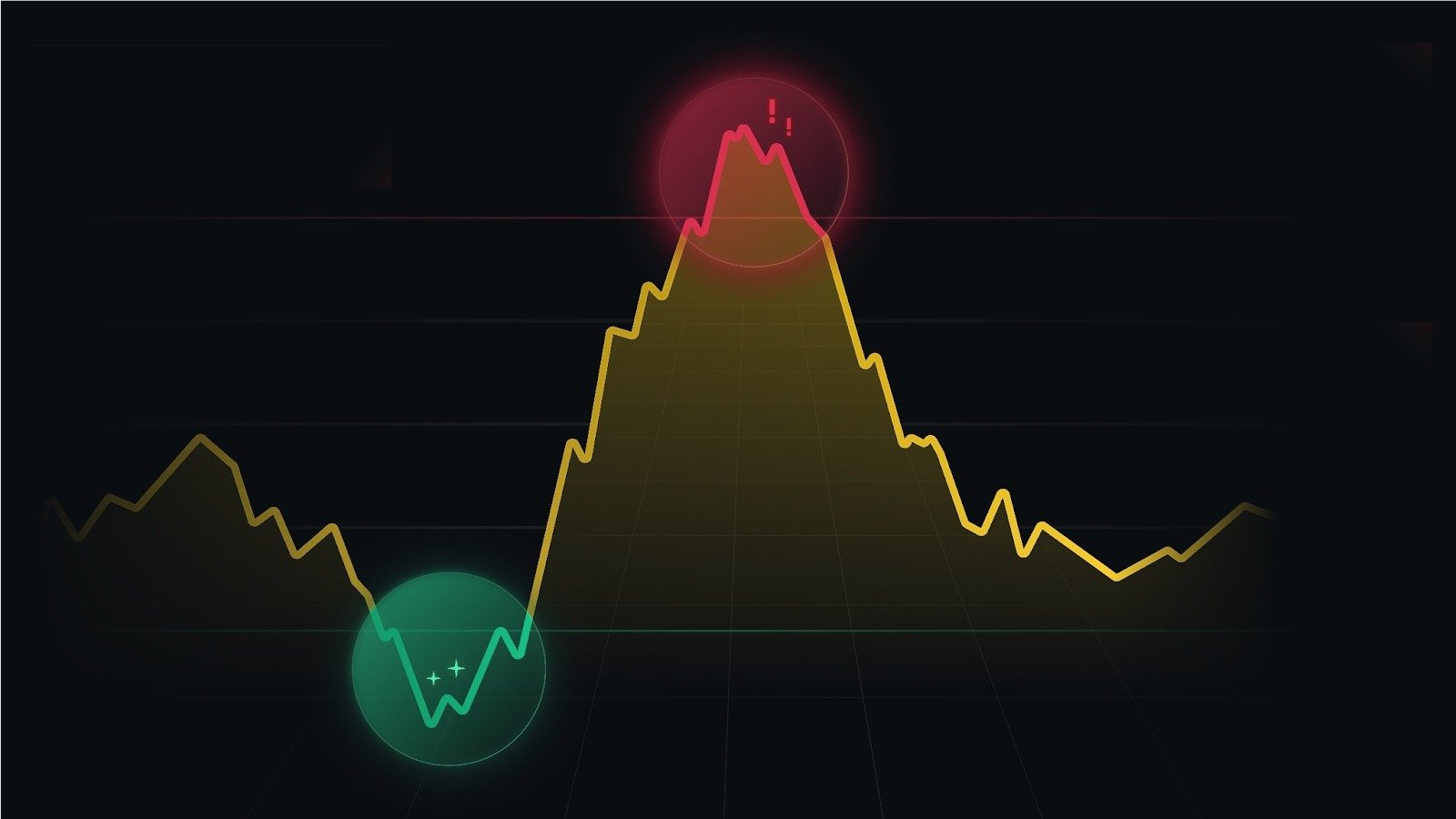

In an era where financial transactions occur at lightning speed, figures representing the total value of transactions can boggle the mind. Recently, the aggregate transaction volume has soared to nearly 3.5 trillion. What does such an enormous figure really say about our economy and society? In this post, we’ll explore the implications of this staggering number, examining the nuances behind the transaction data and what it means for businesses, consumers, and the economy at large.

Understanding the Landscape of Transaction Volume

Transaction volume is more than just a number; it’s a reflection of economic health and consumer behavior. Let’s break down what contributes to this colossal figure.

Economic Health Indicator

The transaction volume serves as a crucial indicator of economic activity:

- Growth Trends: A growing transaction volume often correlates with a healthy economy. When people and companies are buying and selling goods/services, it signifies confidence in both personal finances and broader market conditions.

- Recession Signals: Conversely, a decline in transaction volume can signal economic distress. If businesses and consumers are hesitant to spend, it might point to underlying economic issues.

Fragmentation Across Sectors

Diverse industries and sectors contribute to the transaction total, and understanding this fragmentation offers deeper insights:

- E-commerce Boom: The rise of online shopping has drastically increased transaction volume, especially post-pandemic. Companies like Amazon and Alibaba have capitalized on this digital shift, making shopping convenient and instantaneous.

- Mobile Payments: Platforms like Venmo and Apple Pay have simplified transactions, leading to a dramatic increase in the frequency of smaller transactions. According to Statista, nearly 23% of global e-commerce is expected to shift to mobile platforms by 2025, further highlighting this trend.

Implications for Businesses

The sheer scale of transaction volume imposes varying implications for businesses across the spectrum.

Adapting to Consumer Behavior

- Personalization: As consumer behaviors shift, companies must utilize data analytics to understand purchasing patterns. Tailored marketing strategies can enhance customer engagement, resulting in increased transaction volumes.

- Digital Transformation: Companies that embrace digital solutions to facilitate transactions can thrive. Whether it’s through optimizing mobile apps or enhancing online platforms, businesses have a significant opportunity to increase their transaction volume.

Competitive Landscape

- Market Saturation: Higher transaction volumes can lead to increased competition, especially in saturated markets. Businesses must innovate or diversify to maintain their share.

- Customer Retention Strategies: With so many options available, maintaining customer loyalty is essential. A company focused on exceptional customer service can differentiate itself and, consequently, boost its transaction volume.

Consumer Perspective: What Does This Mean for Us?

From the consumer standpoint, a transaction volume nearing 3.5 trillion has both positive and negative facets.

Enhanced Shopping Options

- Variety of Choices: Increased competition among businesses results in a broader range of products and services available to consumers.

- Price Sensitivity: More options often lead to more competitive pricing, benefiting consumers through cheaper prices and better value for money.

Financial Behavior Insights

- Transaction Patterns: Understanding how consumers conduct transactions can offer insights into broader behavioral shifts. For example, younger generations are increasingly relying on digital wallets and mobile payments.

- Financial Literacy: As transactions become easier, the onus is on consumers to stay informed about personal finance management. Educating oneself about spending, saving, and investing becomes vital.

Broader Economic Signals

The larger economic implications of such high transaction volumes touch various aspects of society.

Inflation and Cost of Living

As transaction volumes grow, they may also be signaling rising prices or inflation rates. When consumer demand elevates sharply, prices tend to rise, impacting purchasing power.

Technological Advancements

The incredible transaction volume epitomizes the rapid technological advancements shaping the financial landscape. Innovations in fintech are making it easier for consumers and businesses to transact, which is noteworthy.

“In today’s digital era, transaction volume is the pulse of the economy—reflecting growth, consumer confidence, and technological progress.”

Conclusion

The nearly 3.5 trillion in transaction volume reveals a lot about current economic conditions and consumer behavior. It reflects growth opportunities for businesses, presents a plethora of options for consumers, and indicates broader implications for economic health. Both entrepreneurs and consumers must navigate this evolving landscape thoughtfully.

As we continue to witness shifts in transaction behavior, businesses should monitor these trends closely to adapt strategically. And for consumers, understanding this dynamic can empower better financial decision-making.

Have thoughts on how the transaction volume impacts you or your business? Share your insights in the comments below!