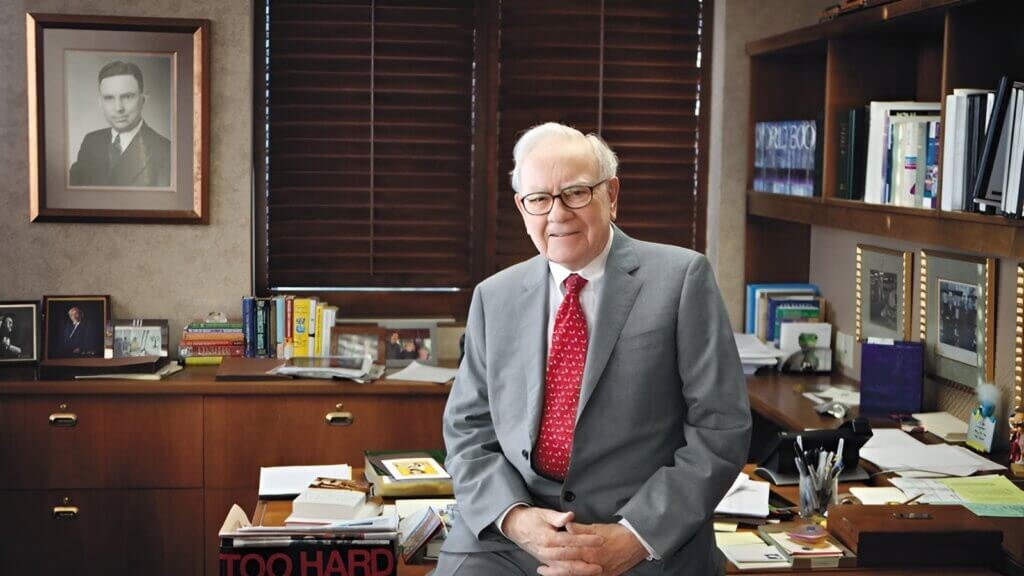

Here’s Why Warren Buffett Will Stay Neutral On the 2024 Presidential Election — and what that means for Investors

The 2024 U.S. presidential election is now just around the corner, and with it, investors are watching closely to ascertain how this will play out in regard to financial markets. With all the endorsements, political campaigns, and debates going on, Buffett’s decision to remain neutral in his auction for an upcoming election is quite a surprise. Buffett, often referred to as the Oracle of Omaha – after his home city in Nebraska – is a sage investor and financial bellwether. For the simple reason that no one knows what not endorsing a candidate will mean for their portfolios or even just generally his view on 2024.

Buffett Through the Years in Politics

Given his history in U.S. politics, it is necessary first to examine how important Warren Buffett could be as a neutral player in 2024 before fully appreciating this significance. Buffett has also been confident about jumping into political debates throughout history. He has endorsed one of his opponents, Democratic candidates — first Barack Obama in 2008 and then Hillary Clinton in 2016. During the election year of 2020, Buffett became a headline-maker yet again as he backed Democratic nominee Joe Biden and argued for more middle-class-friendly policies to combat wealth inequality.

In the past, Buffett has weighed in on elections based on his economic affinity for plans that promote growth and equality. He was outspoken about the need for higher taxes on the rich and expressed his views publicly as well, which gave him a cachet with investors and business leaders. Yet his decision to stay out of the 2024 presidential race creates a new dynamic, and people are still trying to interpret what that means.

Buffett on the Sidelines

There are many reasons why Warren Buffett might be neutral in the 2024 election. For starters, Buffett has always been firm in telling investors to worry about the long-term fundamentals of the economy rather than all of the short-term noise from politics. This latest jibe is further confirmation that Buffett believes investors should not be swayed by political rhetoric, focusing instead on the long-term value creation and financial sustainability of businesses in which they are investing.

One thing that could still keep Buffett neutral is the political uncertainty of today, which has only gotten worse in this fragmented world. It appears that the 2024 election will be highly polarized, with divergent presidential candidates on critical areas such as taxation and regulation policy. At the same time, Buffett fails to endorse a candidate—might this not signal that he is too wary of being pulled into partisan politics and would rather revel in market metrics than the notions of certain politicians?

Another reason Buffett might be ambivalent is his age and the position he has at Berkshire Hathaway. At 94 years old, Buffett’s attention may be more on the agenda of a Biden administration than getting involved in politics. And maybe his always will be to focus on keeping things steady at the home office, so to speak, with no need or desire for political involvement.

What Buffett’s Neutral Stance Means for Investors

The lack of intervention by Warren Buffett in the 2024 presidential election may have some meaning for investors. Here are some key takeaways:

1. This is not a place for politics: Online display; Focus on the Fundamentals

One key tenet of Buffett’s investment philosophy is to zero in on the underlying story of a business rather than follow with external basis factors like political results. Investors can be reminded by it, the same people whose success in their investments depends too much on what party is ruling. Buffett argues that investors should instead invest in businesses with solid fundamental growth, decent competitive moats, and competent Management.

The stock market tends to become more volatile in election years because of the uncertainty that surrounds changes in policy that can bring short-term moves. The Judicious Investor Takes A Cue From Buffett. Nevertheless, it is the stance of an investor like Warren Buffett that prompts investors not to react impulsively after election results and rather look at a long-term horizon. This helps mitigate the volatility that is often synonymous with political transition and, again, can be achieved through robust allocation to a portfolio of solid businesses that have demonstrated strong performance for years.

2. Uncertainty Diversifies Its Risk

Diversification to Manage Risk: The Path Advised by Buffett’s Management of Risk was always remarkable. Given the 2024 election, diversification becomes even more important. For example, political uncertainty often causes markets to move one way or another—some sectors may be particularly influenced by the policies of a winning candidate. Having a properly diversified portfolio will deprive adverse political outcomes of their ability to make your life worse.

Given his own position, Buffett telling you to go neutral is pretty much as close as he’ll get to spit out what amounts to an endorsement of diversification for uncertain times. Instead of trying to guess which sectors would prosper or suffer under a certain candidate, investors should diversify their investments across industries and asset classes to ameliorate risk and enhance potential returns.

3. American Economy Shows Resilience

Warren Buffett, the world’s largest investor and oracle of Omaha, uttered something else about his faith in enjoying a recovery soon enough for our economy. His choice not to back a competitor in 2024 could be confirmation of his certainty that the U.S. economy is adequately strong from commend without help. Renowned investor Warren Buffett is known for having more faith in America’s growth than the GDP deniers do, saying repeatedly that innovation and entrepreneurial spirit can help to grow the U.S. economy out of any challenge with a fast-acting legal system fostering competition from nipping monopolistic behavior before it poisons things too badly.

4. Why Not to Jump Ship

In periods of uncertainty, investors often become jittery and contemplate making more substantial adjustments to their portfolios. However, one of Buffett’s most famous lines is, “Be fearful when others are greedy and be greedy when others are fearful.” He has decided NOT to endorse in the 2024 election, letting us all know, just as I did earlier, that we must keep our eye on the ball and not lose focus based upon momentary political winds.

Patience and discipline have always been a part of Buffett’s investing mantra. He tells investors to buy (high-quality companies) and hold forever, irrespective of market conditions or political events. In maintaining neutrality, Buffett is showing investment hopefuls that it might be better not to try not to time the market based on election results; rather, they should stay focused on their long-run financial ambitions.

What Market Reactions to Expect in 2024

Warren Buffett’s detachment is a good reminder of why long-term fundamentals should be in focus, but it would be good to think about the market paths possible after 2024. The move higher is likely more technical than votes-based, said Stovall, and after the election, results in certain sectors might be whipped around a little bit due to expectations of some policies.

Tech and Innovation: This sector outperforms whenever an election leads to a technology-boosted environment, as it should in industries like tech (obviously), renewable energy, or even biotech. Investors with exposure to these sectors should see increasing government funding and favorable regulatory environments.

Alternative Energy & Fossil Fuels: Conversely, should the candidate who eventually wins be seen as more favorable to traditional forms of energy production such as fossil fuels, fresh impetus for this sector would theoretically come into play. Given the potential for more oil and gas exploration, along with avoiding regulation, healthcare reform, tax cuts, and infrastructure spending, would be a powerful tailwind for Utilities as well.

Financials: The financial sector is prone to taxation and regulations, and changes in them can be costly. Shareholders of banks, insurance companies, and other financial firms need to brace themselves for policy adjustments that could alter their profitability trajectories.

Buffett’s Legacy and Broader Perspectives

Given Warren Buffett’s broad investment philosophy, which seems consistent with his own decision that the logical action to take in 2024 is no action? Buffett has always made a rational decision; the horizon is long enough, and he knows that it’s okay to stay calm when things start crumbling. His impartialness is in itself a timely reminder for investors that political events, no matter how critical they may be from an economic point of view, should not necessarily overshadow their investment strategies.

Buffett either created an explicit version of hedge fund strategy (long-term short put) or simply showed the world how much alpha a nonstop flow of money could produce over nearly half a century. His adherence to value investing—buying good companies at a fair price and holding them for the long term—has made him one of history’s most successful investors. In abstaining from presidential endorsement for 2024, Buffett remains principled and calls on others to do the same.

Conclusion

Although Warren Buffett has always been bold in making political endorsements in presidential elections in the past, his apparent neutrality pertaining to the 2024 contest is actually not an awful fit for a man best known as a contrarian investor. Buffett in the middle serves as a good reminder to investors that they should keep focused at all times on their fundamentals, ensure diversification, and not get sucked into political turbulence. While there may be short-term ramifications from the election, one thing that won’t change is this: The U.S. economy is strong, and quality investments are likely to remain just that.

Behind the headlines, intelligent investors should ultimately be guided by one of Buffett’s oldest quotes: “Be fearful when others are greedy and greedy when others are fearful.” This is particularly true of events that may only have short-term impacts. In this way, they can prosper regardless of who holds the Oval Office, facing down both the trials and tribulations to build up wealth in that political landscape.

For more trending news visit Dailyforesight